SAVINGS & INVESTMENTS

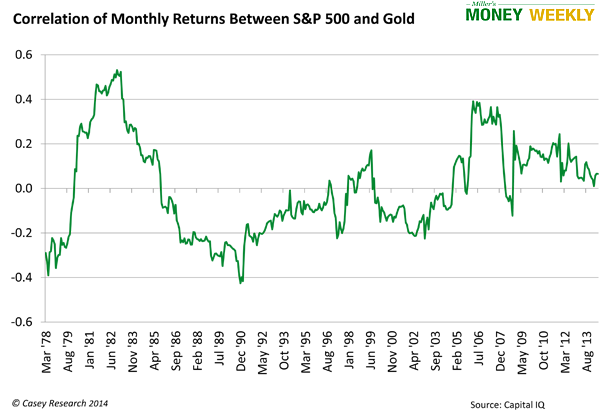

To paraphrase Scottish novelist Andrew Lang, some people use statistics like a drunk uses lampposts—for support rather than illumination. Numbers can be twisted and abused to support false claims, and even correct data is sometimes misinterpreted.

June 30, 2014 at 9:59 a.m.