Dear Savvy Senior,

What retirement planning tips can you recommend to single women? I’m a divorced 58-year-old women with a teenaged son and have very little saved for retirement.

–Financially Vulnerable

Dear Vulnerable,

It’s an unfortunate reality, but many single women – whether they’re divorced, widowed or never married – face much greater financial challenges in retirement than men.

The reasons behind this are because women tend to earn less money – about 82 cents for every dollar that men make, on average, and they have shorter working careers than men due to raising children and/or caring for aging parents. And less money earned usually translates into less money saved and a lower Social Security benefit when you retire.

In addition, women live an average of five years longer than men, which requires their retirement income to stretch farther for living expenses and healthcare costs. And, according to some studies, women tend to have less confidence about financial issues than men, which means they don’t always manage their money as well as they should.

Because of these issues, it’s very important that women educate themselves on financial matters and learn how to save more effectively. Here are some tips and resources that may help.

Start Saving Aggressively

If your employer offers a retirement plan, such as a 401K, you should contribute enough to at least capitalize on a company match, if available. And if you can swing it, contribute even more. In 2023, you can save as much as $22,500 in a 401(k), or $30,000 to those 50 and older, due to the catch-up rule.

If you don’t have a workplace plan, consider opening a Traditional or Roth IRA. Both are powerful tax-advantaged retirement savings accounts that let you contribute up to $6,500 annually, or $7,500 when you’re over 50. And if you’re self-employed, consider a SEP-IRA, SIMPLE-IRA and/or a solo 401(k), all of which can help reduce your taxable income while putting money away for retirement.

Also, if you have a high-deductible health insurance policy (at least $1,500 for self-only coverage or $3,000 for family coverage), you should consider opening a health savings account (HSA). This is a triple tax advantage tool that can be used to sock away funds pre-tax, which will lower your taxable income; the money in the account grows tax-free; and if you use the money for eligible medical expenses, the withdrawals are tax-free too.

Pay Off Debts

If you have debt, you need to get it under control. If you need help with this, consider a nonprofit credit-counseling agency that provides free or low-cost advice and solutions, and can help you set up a debt management plan. To locate a credible agency in your area, use the National Foundation for Credit Counseling website at www.NFCC.org(800-388-2227), or the or the Financial Counseling Association of America FCAA.org (800-450-1794).

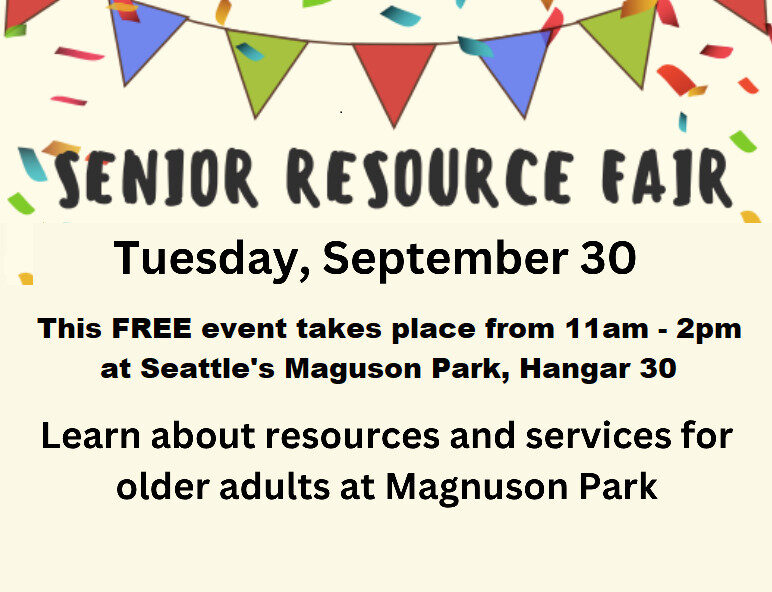

Find Help

To help you educate yourself on financial matters like retirement planning, saving and investing, health care, annuities and more, a top resource is the Women’s Institute for a Secure Retirement at www.WiserWomen.org.

And to help you get up to speed on Social Security, visit www.SSA.gov/people/women. This web page, dedicated to women, provides helpful publications like “What Every Woman Should Know,” along with links to benefit calculators and your personal Social Security account to help you figure out your future earnings at different retirement ages.

You should also consider getting a financial assessment with a fee-only financial advisor. Costs for these services will vary from around $150 to $300 per hour, but this can be very beneficial to help you set-up a retirement plan you can follow. See www.NAPFA.org or www.GarrettPlanningNetwork.com to locate an advisor in your area.

Send your senior questions to: Savvy Senior, P.O. Box 5443, Norman, OK 73070, or visit SavvySenior.org. Jim Miller is a contributor to the NBC Today show and author of “The Savvy Senior” book.