How to invest in your future despite an economic recession

April 29, 2020 at 8:28 p.m.

By Maddie Smith

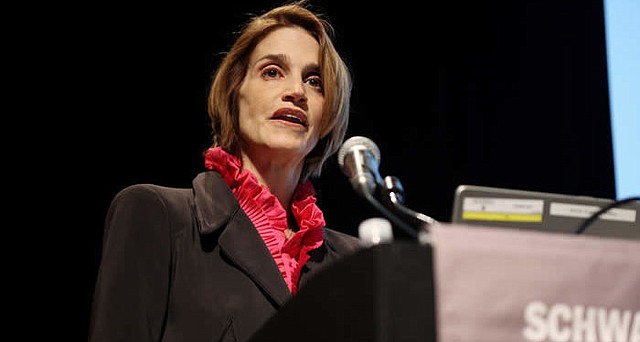

Consuelo Mack, the host of Wealthtrack, sat down with two financial professionals to discuss financial planning and retirement during the COVID-19 crisis.

“Retirees and near-retirees have suffered a punch to the gut,” said Mack.

The pandemic has shown devastating effects on markets. For countless people, life savings wrapped up in the markets plummeted in the wake of the economic recession.

Mack invited Teresa Ghilarducci and Jamie Hopkins to a conversation on coping financially with the recession and preparing for retirement. Here is what they have to say:

Teresa Ghilarducci- Professor of Economics at The New School for Social Research, Director of The New School’s Retirement Equity Lab, Director of the Schwartz Center for Economic Policy Analysis, and co-author of Rescuing Retirement: A Plan to Guarantee Retirement Security for All Americans

Ghilarducci’s take home advice for the conversation was to delay collecting social security for as long as possible. Her reasoning behind this was that retirees who delay their benefits will receive a larger percentage. Most people claim their social security benefits between the ages of 62 and 64. Often, if a retiree defers their benefits for just six more months, they will receive a greater percentage of social security income.

Ghilarducci urged listeners to trust in social security. Though many employers do contribute to worker’s 401Ks, they contribute a higher percentage to social security.

Throughout the conversation, Ghilarducci stressed the importance of selecting a fiduciary as a financial advisor. Fiduciaries are certified financial planners who will not make money by selling a financial product to a client. One way to tell if a financial advisor is a fiduciary is by asking the question “Do you make money off of the advice that you give me,” said Ghilarducci.

She also suggests that a good fiduciary rule-of-thumb is to make sure there is an initial fee upon meeting with them. Non-fiduciary financial advisors often do not charge an initial fee, but will take 1% of their client’s assets.

“I wish we had a law that made financial advisors do what lawyers have to do, which is to do some pro bono work,” said Ghilarducci.

Often financial advisors will encourage clients to send their kids to expensive private schools without having access to all of their financial information. These clients sometimes have to borrow money from their retirement fund or other assets to afford the school down road. Pro bono work could restore some honesty to the financial advising process and hopefully avoid clients spending money that they don’t have.

Ghilarducci said that a good goal for 30-year-olds is to be employed and debt-free. By the time an individual is 50, they should pay special attention to their diet. She advises people to eat as though they have diabetes starting in their 50s.

“Diabetes is expensive and it won’t kill you,” said Ghilarducci.

Taking measures to prevent diabetes starting at a young age will protect long-term physical and financial health.

She added that avoiding debt by downsizing will help individuals’ finances in the long run more so than their assets.

Jamie Hopkins- Finance Professor at Creighton University College of Business, Director of Retirement Research at Carson Wealth, Author of Rewirement: Rewiring the Way You Think about Retirement

Hopkins agrees with Ghilarducci about trusting in social security income.

“[Social security] is the best and most official financial instrument in the world,” said Hopkins.

He also advised the audience to look for a fiduciary. Weeding through financial advisors to find a fiduciary can be a difficult process. The majority of advisors are not fiduciaries.

“I would hire about 5% of the advisors in the world,” he said.

When meeting with an advisor it is important to focus on financial planning. Individuals who spend time planning out their retirement will have more success down the road. He recommended writing up a retirement and estate plan, even for those who don’t have huge assets. If a financial advisor does not suggest planning, they are likely not a fiduciary.

Finding a holistic retirement income planner can be a difficult process, said Hopkins. There are many different aspects to take into consideration when planning for retirement including risk management, deferring social security, managing expenses and health care. Looking for a single license from a financial advisor is not going to offer the client sound advice for all of these things.

Here are Hopkins suggestions for finding reliable retirement income planners:

Look for a fiduciary-- the certification to look for here is Certified Financial Planners (CFP). To ensure that an advisor is a fiduciary, a client can ask them to put it in writing.

Find a Retirement Income Certified Professional (RICP)-- this is an add-on to the CFP certificate that specializes in retirement income planning. People with this certification will be more holistic in their planning and take into account aspects like shifting assets into income, medicare planning, long-term health care planning

Hopkins’ life-long financial planning advice to listeners is to begin investing in yourself in your 20s. Spend money on things that will help the long-term plan: go to college, travel, stay healthy to avoid long-term health conditions and things of that nature.

By the time an individual is 30, they should plan to be debt-free.

“If you fall behind with debt, it’s going to be really hard to overcome that,” he said.

As far as investing in retirement, the earlier people are able to start saving and the longer they can keep retirement savings untouched, the better they will be. Index funds are usually the best bet for people who want to begin saving for retirement.

Despite higher expenses for people in their 30s, Hopkins encourages people to begin saving for retirement during this decade. Retirement is a lot harder down the road if someone begins saving for retirement in their 40s.

Hopkins said that the age range between 40 and 55 is typically an individual’s highest earning period.

“That’s where we’ve got to spread out wealth,” he said.

One way to spread out the wealth is to consume less and think of retirement savings as future income.

Hopkins said that mentally preparing for retirement can be difficult for some people. Preparing for retirement mentally can start as early as 50-years-old. People often struggle with spending money set aside in a retirement fund when the time comes. Hopkins’ book Rewirement: Rewiring the Way You Think about Retirement focuses on spending retirement funds when the time comes.

“It’s really that transition from accumulation to decummulation,” he said.

How do you find a financial fiduciary?

Fiduciary advisors are required to act in their client’s best interest at all times. The difference between fiduciary and non-fiduciary advisors is that fiduciaries do not receive compensation for selling financial products to their clients. Non-fiduciary advisors are also called brokers, according to Ferguson Johnson Wealth Management. Brokers operate under a different system than fiduciaries. They earn commission for selling certain financial products or investments to their clients. Brokers can advise a client to invest a certain way or purchase a certain product because they will make a higher commision rate from it, despite the best interest of their client. Fiduciaries, on the other hand, charge their clients a fee and are required to offer financial advice in their client’s best interest.

Hopkins’ advice for ensuring that a financial advisor is a fiduciary is to ask them to put it in writing. This legally ensures that they are a fiduciary and holds them accountable to the advice they give to their clients. Getting it in writing is a useful tip once an individual already thinks they have a fiduciary, but wading through financial advisors to find that fiduciary can be like trying to find a needle in a haystack.

One way to determine if an advisor is a fiduciary is by looking on their website for a disclosure statement. Keywords to look for here are “registered investment advisor,” which is another term for a fiduciary, and “registered broker-dealer,” which means that the advisor is a broker. It is important to note that some firms are duel registered, meaning that they can act as both fiduciaries and brokers at separate times. On websites of dual-registered firms, they will have disclosure statements identifying them as both registered investment advisors and registered broker-dealers.

Another way to tell if a firm or advisor is a fiduciary is to look them up on the Investment Advisor Public Disclosure website. This tool will indicate if a firm or individual has a disclosure statement that indicates whether or not they are a fiduciary along with the years of experience the firm or individual has with financial advising.