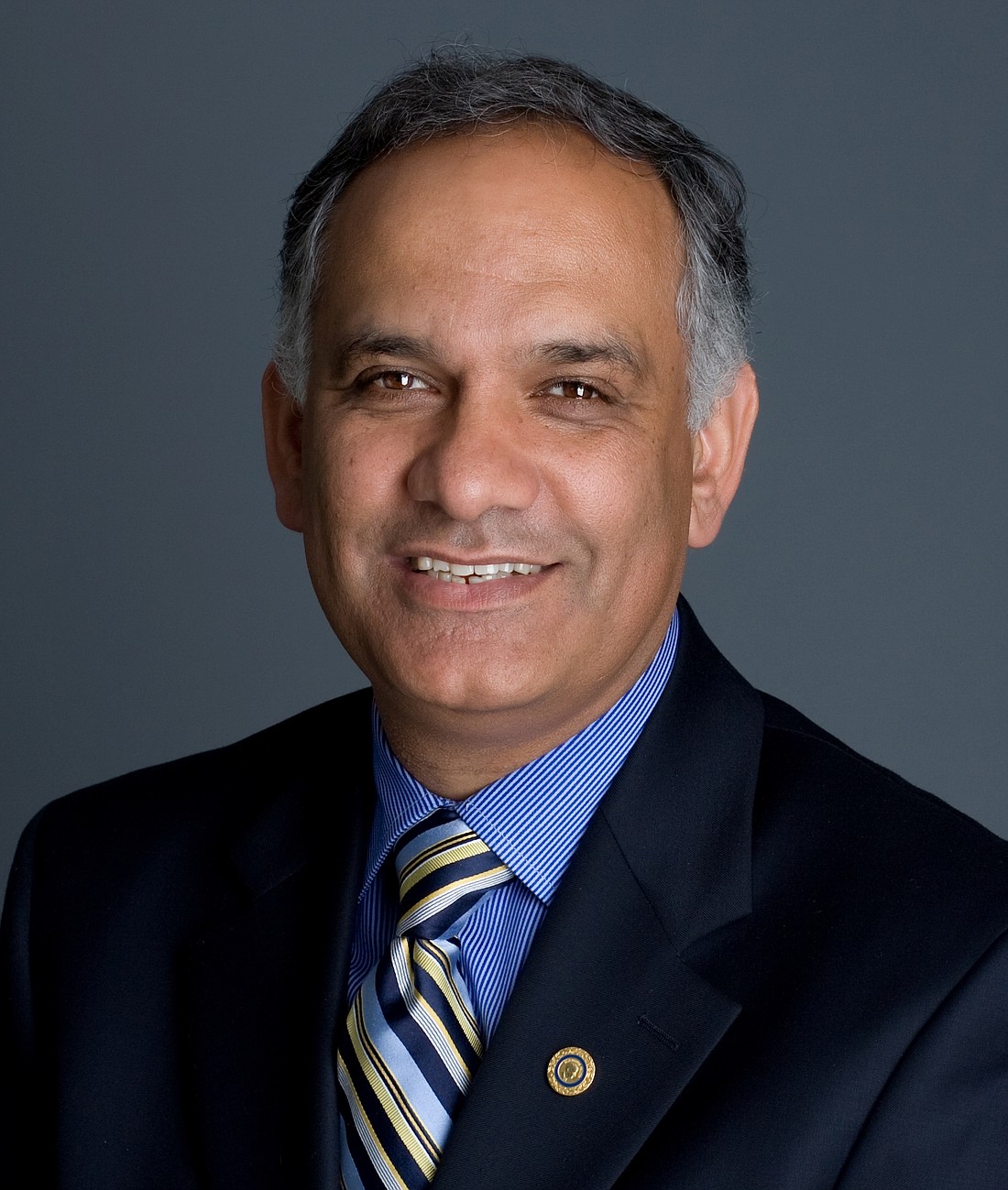

Hello MrNagaich,

My 77 year-old husband, has been retired and drawing Social Security for several years. I am 67 years-old and still working full-time and will probably work until at least age 68. I was told by a financial manager that I could continue working full time and apply now for half of my husband's Social Security benefit and yet he would still continue to receive his usual monthly payment. That seems odd to me and I wondered if indeed that is true? It sounds too good to be true. And if so, then could I switch over to applying for my earned benefit without penalty when I turn 68 years old?

Ruth F~

Dear Ruth,

Every now and then the old adage ‘If it sounds too good to be true, it probably is’ isn’t always true. The financial manager is correct. You can elect to take 50 percent of your husband’s benefits while he continues collecting his own. Meanwhile this allows your benefits to continue increasing. At age 68 or any time after that, but not beyond age 70, you can go back and switch to your own if those benefits are higher. My suggestion for you would be to wait until age 70 before you take your own benefits. This will allow your benefits to be as high as they can be. Women generally outlive men and so incomes are important to protect for a time when you might have to make do with only your own income.

Here’s how it works. Your full retirement age is 66 if you were born between 1943 and 1954. Once you reach age 66 and your spouse has filed for his/her own benefit, you can either claim your own Social Security benefits or half of your spouse’s benefits. If you choose to collect your spouse’s benefit and delay receiving your retirement benefits until a later time, your retirement benefit grows by 8 percent each year until you reach age 70, at which point your retirement benefit will be paid at 132% per month. You can only do this if you wait until full retirement to start benefits.

Rajiv.

Dear Rajiv,

I am caring for my elderly mother who was diagnosed with Alzheimer's 5 years ago. Right now, she lives with me, my husband, and our 10 year old son. I'm not sure how much longer we'll be able to keep her at home because I work full-time and she is reaching the stage where she can be very paranoid and distressed. I would like to have her go to an assisted living/Alzheimer's care facility as opposed to a nursing home because, like most Alzheimer's patients, she is not physically sick. The issue is, of course, money. She has about $2187 per month income from a combination of RSDI and Teacher Retirement. She has no other liquid resources. Her out-of-pocket medications run about $250 per month. My father served in World War II. Can you tell me a little bit more about what might be available through VA and any other options I may not have considered?